Using your Tax Refund to Purchase a Santa Fe Home

Thinking about getting your family into a Santa Fe home in 2017? I’m here to help. And using your tax refund as a down payment may just work for achieving that goal.

Thinking about getting your family into a Santa Fe home in 2017? I’m here to help. And using your tax refund as a down payment may just work for achieving that goal.

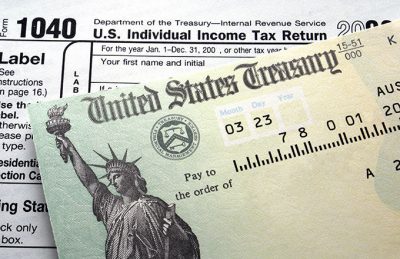

For a lot of wage earners, the beginning of the new year signals one of their favorite events – the arrival of their W-2s, which leads to filing a quick tax return and waiting very patiently for what could be a hefty tax refund. I remember those days from before self-employment when, because I had small children and qualified as head of household, my refunds would run in the thousands of dollars.

If you fall into that category, you might want to consider depositing that check and NOT spending it while you explore the option of purchasing a home. Buyers who qualify for USDA loans don’t need any money down, which means your tax refund could be used to pay closing costs.

Buyers who qualify for an FHA loan, especially first-time buyers, will only need a 3.5% down payment. I’m not an incredible math whiz, but what that means is that for ever $100,000 you spend, your down payment is only $3,500. If you’re a first-time buyer, you may also get some down payment assistance from New Mexico Mortgage Finance Authority. That means you could potentially use your tax refund as your entire down payment. And frequently we can get sellers to help with closing costs.

If you’re leaning toward this option, just be sure you put the tax refund in the bank and don’t cash it. Mortgage companies want to be able to track the funds you use for down payments. If you cash the check and then later choose to deposit some or all of the cash back into your bank account, you’ve muddied the waters for your mortgage loan specialist.

Even if you don’t want to use the tax refund as a down payment, you can use it to pay down debt or to build a financial reserve, both of which will help you toward qualifying for a mortgage in the long run.

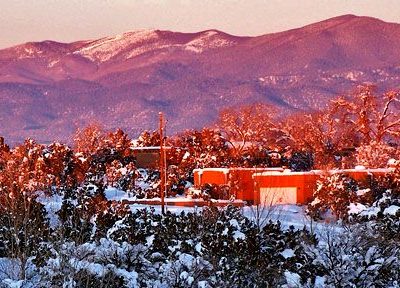

Could 2017 be the year you finally get into your Santa Fe dream home? If you handle your tax refund wisely, the answer is yes. And guess what! When you own a home, you get to deduct mortgage interest, which means that next year your refund could be even larger.

Finding a good mortgage lender who can help you figure all this out is essential. Give me a call or shoot me an email so that we can discuss your best options. I’ll send you the names of several lenders who are experts at helping first-time buyers get qualified.

And Happy New Year! I can’t wait to help you find your dream home.

Bunny Terry 505.504.1101

20 Vereda Serena Santa Fe, NM 87508